how much does illinois tax on paychecks

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

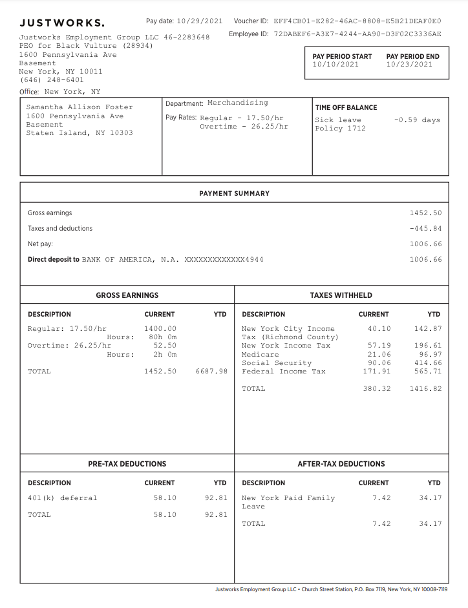

Trump Payroll Tax Holiday How It Affects Paychecks In 2021 Money

The Illinois income tax was lowered from 5 to 375 in 2015.

. How Much Does Illinois Tax On Paychecks. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois.

Just enter the wages tax withholdings and other information required. This is a projection based on information you provide. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of.

This calculator is a tool to estimate how much federal income tax will be withheld. Employees who desire to update their. How much does wisconsin take.

If youre a new employer your rate is 353. Therefore fica can range between 153 and 162. If you have not enrolled in direct deposit you can enroll through MyIllinoisState.

Payroll benefits and everything else. 2022 Federal Tax Withholding Calculator. Need help calculating paychecks.

Enroll in direct deposit so your funds will be in your account on payday. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. This 153 federal tax is made up of two parts.

The wage base is 12960 for 2022 and rates range from 0725 to 7625. 505 on the first 44470 of taxable income. What percentage is taken out of paycheck taxes.

If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Additional Medicare Tax. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

915 on portion of taxable income over 44470 up-to 89482. Personal Income Tax in Illinois. So the tax year 2022 will start from July 01 2021 to June 30 2022.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. How much tax is deducted from a paycheck Canada. How To Calculate Taxes Taken.

Newly registered businesses must register with IDES within.

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Illinois Income Tax Rate And Brackets 2019

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

What Are Employer Taxes And Employee Taxes Gusto

Illinois Paycheck Calculator Adp

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

How Much In Federal Taxes Is Taken Out Of Paychecks

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

New York Hourly Paycheck Calculator Gusto

Illinois Paycheck Calculator Smartasset

Here S The Average Irs Tax Refund Amount By State

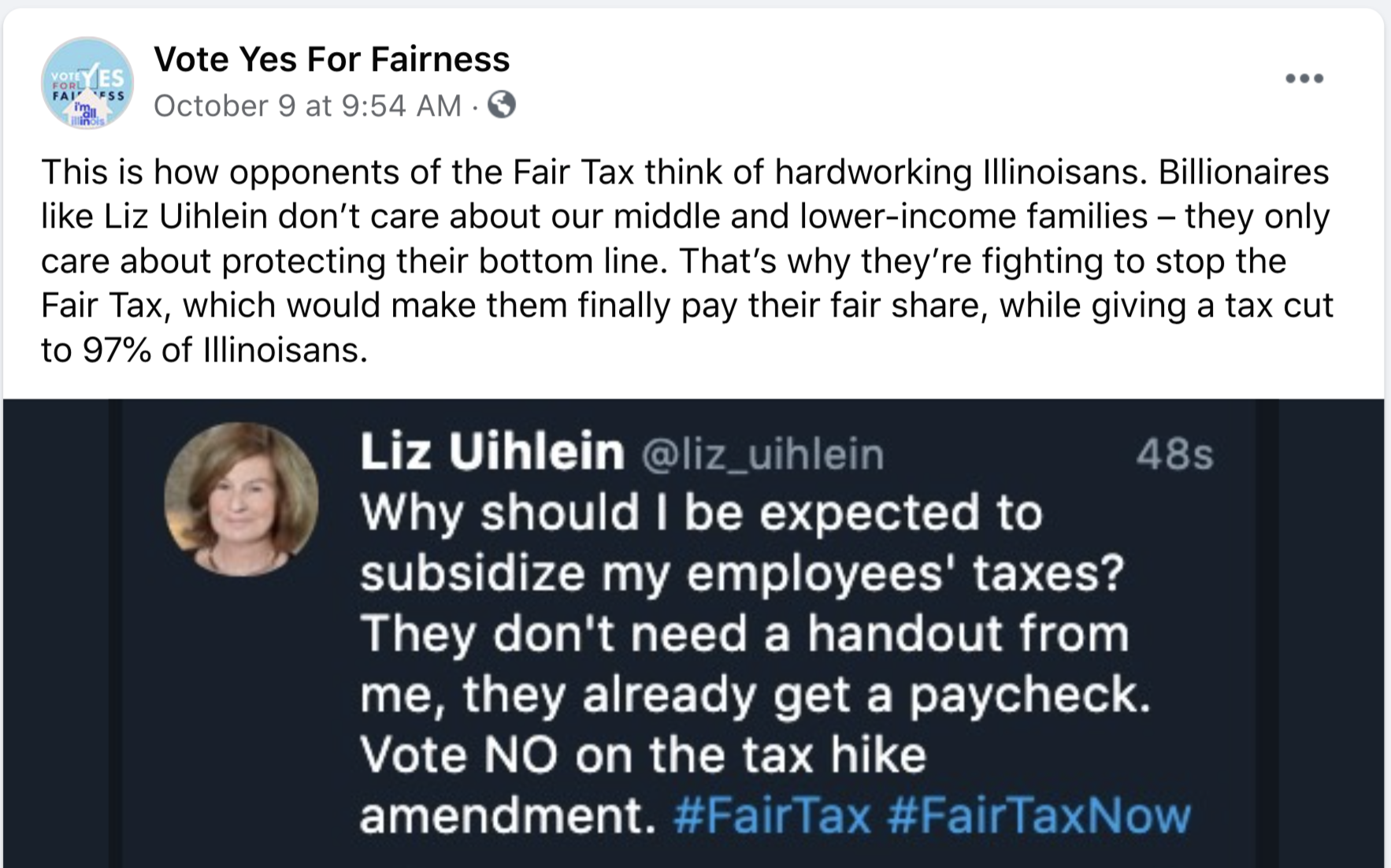

Pritzker Fair Tax Group Pays Over 10 000 To Push Fake Tweet

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Vote Yes For Fairness This Is How Opponents Of The Fair Tax Think Of Hardworking Illinoisans Billionaires Like Liz Uihlein Don T Care About Our Middle And Lower Income Families They Only